Breaking News

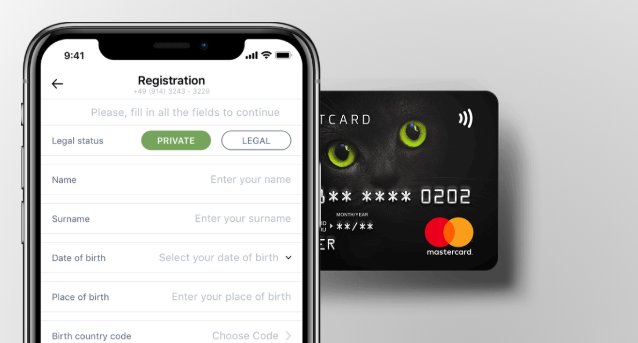

Blackcatcard Launches New Mastercard Cards

Blackcatcard, a leading provider of financial solutions, has recently announced the launch of their new Mastercard cards.

These cards are designed to offer customers a range of benefits and features that are tailored to meet their specific needs.

Benefits of the New Blackcatcard Mastercard

The new Blackcatcard Mastercard comes with a host of benefits and features that are aimed at providing customers with greater convenience and flexibility.

Here are some of the key benefits that customers can expect:

- Enhanced Security Features

The new Blackcatcard Mastercard comes with enhanced security features that help to protect customers against fraud and unauthorized transactions.

These features include advanced encryption technology, secure online access, and real-time alerts for suspicious activity.

- Flexible Spending Limits

Customers can set their own spending limits on their Blackcatcard Mastercard, which gives them greater control over their finances.

This feature is particularly useful for those who want to stick to a budget or limit their spending.

- Rewards Program

The Blackcatcard Mastercard also comes with a rewards program that allows customers to earn points for every purchase they make.

These points can be redeemed for a variety of rewards, including cash back, travel rewards, and merchandise.

- Zero Liability Protection

Customers are protected against unauthorized transactions with the zero liability protection feature.

This means that if their card is lost or stolen, they will not be held liable for any fraudulent transactions.

- Mobile App

The Blackcatcard Mastercard also comes with a mobile app that allows customers to manage their account, view their transactions, and make payments on the go.

How to Apply for a Blackcatcard Mastercard

Applying for a Blackcatcard Mastercard is easy and can be done online.

Simply visit the Blackcatcard website and fill out the online application form.

Once your application has been approved, your new card will be sent to you in the mail.

Final Thoughts

The new Blackcatcard Mastercard is a great choice for those looking for a credit card that offers flexibility, convenience, and security.

With a range of benefits and features, it’s easy to see why this card is quickly becoming a popular choice among consumers.

So if you’re in the market for a new credit card, be sure to check out the Blackcatcard Mastercard today!

- Building True Resilience in the UK Payments Ecosystem | Part 7 | Bottomline Read more

- Cheaper, Faster… Riskier: Over Half Of Brits Plan To Use ChatGPT For Completing Their Tax Returns Read more

- Tuum and Abwab.ai Partner to Deliver End-to-End SME Lending Solutions in the Middle East Read more

- Tuum Powers Bank CenterCredit’s Digital Transformation, Setting a Blueprint for BaaS and Core Modernization in Global Banking Read more

- GFT’s Generative AI Credit Risk Assistant to Inform Major Lending Decisions Read more