Breaking News

The Evolution of Digital Wallets: A Shift from Physical Cards by 2030

In the fast-paced world of modern commerce, convenience is king.

One technology that’s been leading the charge in simplifying our payment experiences is the digital wallet, also known as an e-wallet.

These digital marvels have been gaining popularity worldwide, and it’s not hard to see why. They offer consumers a slew of benefits, such as convenience, enhanced security, contactless payments, and the ability to integrate multiple payment methods and loyalty programs into a single app.

In this article, we’ll dive into the world of digital wallets, exploring their rise to prominence and what the future holds for these digital payment solutions.

The Global Surge of Digital Wallets

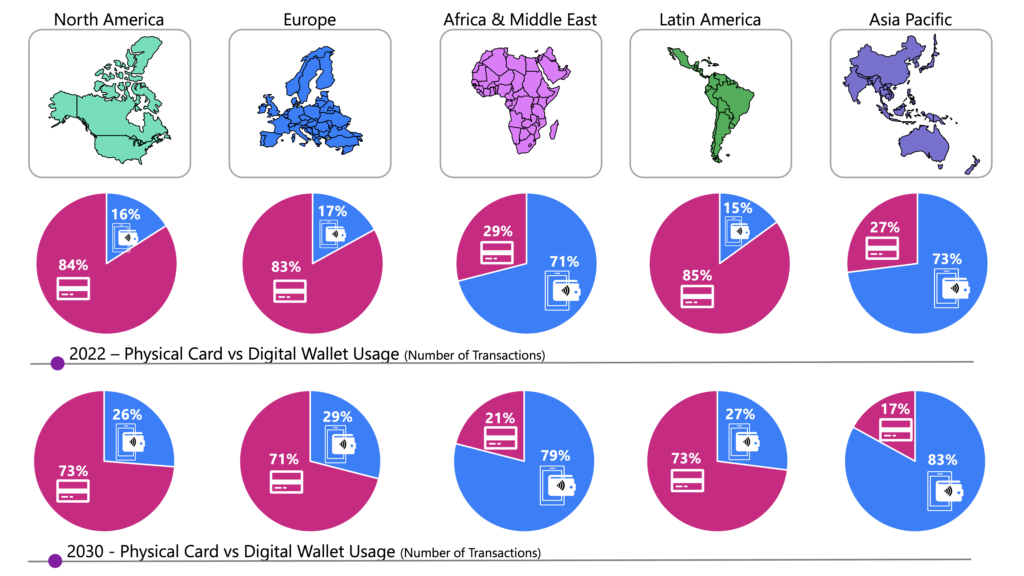

In 2022, the global financial landscape witnessed a significant transformation. For every five transactions, three were conducted using physical cards, while two were made through digital wallets.

The transaction value through digital wallets reached an astounding USD 50 trillion in 2022, with expectations that it will surge to USD 96 trillion by 2030.

However, the adoption of digital wallets isn’t uniform across the globe; it varies due to factors like technological limitations, regulatory environments, and cultural preferences.

Challenges in Analysis

While the shift to digital wallets is clear, conducting a regional analysis of their adoption compared to physical cards poses some challenges.

Firstly, the availability of reliable data about digital wallets in certain regions and countries can be a hurdle.

Secondly, the fact that digital wallets are commonly funded by traditional credit or debit cards can lead to some degree of double-counting of transactions.

Lastly, the diversity of digital payment wallets and their definitions can make comparisons difficult.

Regional Variances in Adoption

The adoption of digital wallets varies significantly across regions.

In Africa, digital wallets have taken a significant leap, skipping physical cards entirely, as physical cards are not widely available or accepted.

In the Asia-Pacific (APAC) region, the dominance of Alipay and WeChat Pay in China has driven digital wallet usage to over 71%.

Localised Success Stories

Digital wallets have evolved at different paces in various markets. For instance, PayPal made a significant impact in Germany, where it established itself as a trusted and convenient payment option for e-commerce when local physical cards weren’t e-commerce friendly.

Kenya’s M-Pesa and Nordic countries’ MobilePay and Swish have also witnessed remarkable adoption.

India’s growth in digital wallet adoption has been driven by the government’s push for digitalization and demonetization of certain currency notes. Paytm and Google Pay have gained popularity for various transactions, thanks to their support of the Unified Payments Interface (UPI).

G-Cash, a popular digital wallet in the Philippines, has expanded its services over the years, offering convenient and accessible financial services to millions of users.

Diverse Payment Methods

Digital wallets support a wide range of payment methods, from credit and debit cards to cryptocurrencies.

Merchants need to evaluate the costs and benefits of supporting different digital wallets to avoid complexity and additional costs in payment processing and reconciliation.

Growth Prospects

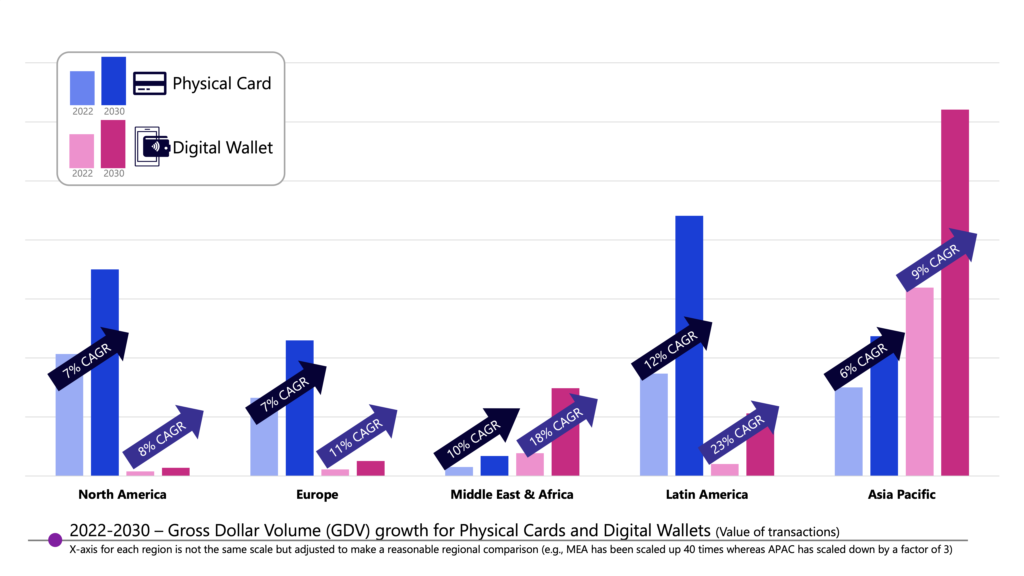

The growth of physical cards in Gross Dollar Volume (GDV) is estimated to be limited, with the exception of Latin America (LATAM), which shows a CAGR of 12%.

Digital wallets, on the other hand, are expected to show impressive double-digit growth in Europe (11%), the Middle East and Africa (MEA) (18%), and LATAM (23%).

In APAC, digital wallets are outperforming physical cards, with an expected 9% CAGR, and the GDV in 2030 is expected to be significantly higher than the combined GDV of the other four regions.

The Rise of Click to Pay

Click to Pay, developed by EMVCo and owned by several major credit card companies, is set to simplify the digital wallet landscape.

Visa, for example, is phasing out Visa Checkout in favour of Click to Pay.

This transition is seen as a defensive strategy as Asian digital wallets expand globally.

Localised Features and Support

Digital wallets have adapted to local regulations, market needs, and consumer preferences.

They offer localised features, language support, and integration with local payment systems.

However, merchants must be cautious not to overwhelm customers with too many wallet options.

Looking to the Future

As we move closer to 2030, the digital wallet landscape is set to grow further, with increased consumer adoption and more sophisticated features.

While digital wallets won’t replace physical cards completely, their life is limited. By 2030, we can expect digital wallets to become the preferred payment instrument, offering a myriad of non-payment-related services for consumers.

Digital wallets have brought a revolution to the world of payments, and their evolution continues.

They cater to the specific needs of regions and are set to become more sophisticated, offering diverse financial services.

As the payment landscape evolves, both merchants and consumers will seek innovative and convenient payment methods that meet their unique requirements.

- Bluefin and Basis Theory Partner to Enable Unified Tokenization Across Digital and In-Person Payments Read more

- Invest Bank and AUTON8 Build Partnership to Drive Digital Resilience and Banking Agility Read more

- ING’s AI Roadmap: Platform, People, and Agentic AI Read more

- UK-fintech Provided Over £17.5m in Emergency Wage Advances to More Than 55,000 Employees in the Last Year Read more

- TreviPay Announces AI-Powered Growth Center to Help Enterprises Predict Buyer Behavior and Drive B2B Sales Read more