Breaking News

Digital Business Banking Platform Tide Reaches Half a Million UK Customers

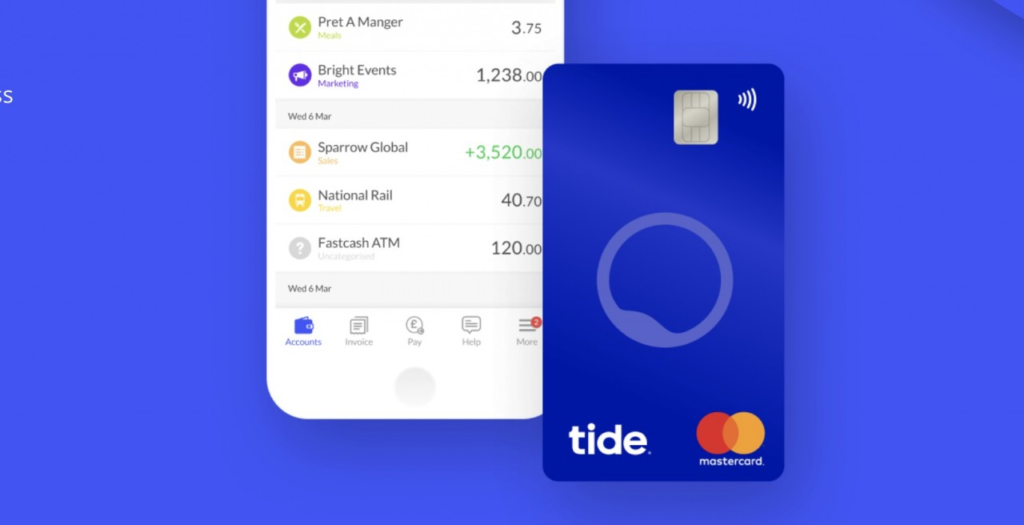

Tide, a digital business banking platform, has recently announced that it has achieved a significant milestone by reaching over half a million customers in the UK.

This marks an impressive feat for the fintech firm, which was launched only six years ago in 2017.

Surpassing its Goal

The achievement means that Tide has far exceeded its initial goal of capturing 8% of the SME banking account market, with 1 in 10 small businesses now using the platform.

Tide’s focus on catering to the needs of small businesses has allowed it to carve out a niche in the industry and attract a loyal customer base.

Tide’s Impact on Female-led SMEs

Tide’s efforts to support female-led SMEs have also paid off, as over 100,000 of its customers are now women-owned businesses.

This is in line with Tide’s goal of reaching this number by the end of 2023, demonstrating the platform’s commitment to promoting diversity and inclusion in the business world.

Oliver Prill, CEO of Tide, expressed his delight at the platform’s success, saying, “Half a million members is a real testament to the quality of our products and services. I am delighted to welcome them all to Tide. Our mission to help SMEs save time and money is proving to be a success with more and more small businesses choosing to open their accounts with Tide.”

Future Plans

Tide’s commitment to helping small businesses goes beyond just providing banking services.

The company plans to launch more products and services this year to help SMEs launch and run their businesses successfully.

Tide is also focused on sustainability and plans to support the Net Zero initiative.

Acquisition of Funding Options

Last month, Tide acquired credit finance marketplace Funding Options, which will become part of a new division of the company called Tide Partner Credit Services.

The acquisition will help Tide to offer more comprehensive services to its customers and strengthen its position in the market.

In addition to its success in the UK, Tide is also expanding its operations in India.

The platform launched its first product in India last year and plans to reach 500,000 SMEs in that market by 2025. Tide’s focus on supporting small businesses has allowed it to make a positive impact in various parts of the world.

Final Thoughts

Tide’s achievement of reaching half a million UK customers is a testament to the platform’s commitment to catering to the needs of small businesses.

With its focus on supporting female-led SMEs, sustainability, and expanding its operations in India, Tide is well-positioned to continue its growth and make a positive impact in the business world.

- WorkFusion Raises $45 Million in Funding to Fuel Growth for Agentic AI for Financial Crime Compliance Read more

- AI-Powered E-commerce, Stablecoins and Local APMs: Emerging Trends Headline EBANX’s Payments Summit in Mexico Read more

- Second Day of Money20/20 Middle East Unveils Next-Gen Solutions at the Region’s Largest Ever Fintech Gathering Read more

- United Gulf Financial Services Joins The Hashgraph Association and Exponential Science Foundation Adding $1M to Hedera Africa Hackathon Pool Prize Read more

- Payhawk Transforms Spending Experience for Businesses With Four Enterprise-Ready AI Agents Read more