Breaking News

EXCLUSIVE: Are super-apps on their way to the UK?

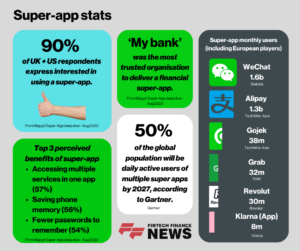

As much as 90% of UK and US internet users would be interested in using a financial super-app, contingent on the services it offers.

That’s according to a brand-new report from Fintech-as-a-Service platform Rapyd, which provided some insight into existing consumer sentiment towards super-apps.

The concept of an ‘app that does everything’ (or rather, a lot of things) has entered Western public consciousness recently, following Elon Musk’s takeover and subsequent rebranding of social media platform Twitter.

Most of the world’s existing super-apps, which offer messaging, payments, ride hailing and more, are situated in Asia and serve quite different markets to those in the West.

But stats in the report above suggest there is some appetite for such a product and a 2022 PYMNTS/PayPal survey also found that 72% of respondents from the UK, US, Australia and Germany were at least “slightly” interested in using a super app. Such products are also becoming more feasible, as embedded finance and open banking technology make both the integration of multiple services in one package and the sharing of customer financial data between institutions increasingly seamless.

In this article we look at the companies working on their own super-app, what these apps might look like in reality and whether the concept will fly with a Western audience? Read on to find out more.

Who wants a Super-App?

From the start of his well-publicised takeover, Elon Musk has made his intentions for X, his rebrand of the Twitter platform, (relatively) clear.

What isn’t clear is how this will work in practice and whether his idea for an app that does everything, something which dates back to his involvement in the creation of PayPal, is anywhere close to materialising.

He’s publicly stated his admiration for the most established and successful super-app, the Chinese based WeChat, and has suggested that something similar should be available to Western consumers. That there are major differences in the two territories doesn’t appear to have dampened his ambitions.

But he’s not alone in pursuing this goal. Several prominent fintech companies are attempting to develop their own super-app and there is clearly some public awareness and support of the idea.

According to a 2022 report, Gartner expects more than 50% of the global population to be daily active users of multiple super-apps, by 2027.

Perceived benefits of a super-app from the Rapyd report included accessing multiple services in one app (57%), saving phone memory (56%), remembering fewer passwords (54%), and enhanced data security by limiting the amount of data shared across apps (48%).

The report also looked at what services people wanted from it, such as, online shopping (63%), ordering food (55%), payments and money transfers (53%), accessing entertainment (50%), and interacting with social media (50%).

Regardless of the features on offer, it’s clear that financial services will play a key role. In reference to the report, CEO of Rapyd Europe & GM of Rapyd Collect and Issuing, Gardar Stefansson, said that “financial services form the bedrock of any comprehensive super-app offering. From payments and money transfers to shopping and food delivery, fintech is at the heart of it all.”

To get another perspective on the topic, I spoke to Jovi Overo, the head of BaaS at Unlimit, a BaaS and payments processing provider. Surveying the landscape, he said that “a lot of commentators see super-apps playing a transformative role in the FinTech landscape” and that the appetite is there “if delivered and executed correctly…” As it stands though, “nobody has packaged it in a way that makes its offering more compelling to users.”

Nobody in the West that is. In southeast Asian territories like Indonesia, they are prevalent and often provide a first major gateway into the world of banking and credit.

Big Apps in Little China

One name universally synonymous with super-apps is WeChat.

Owned by Tencent and officially launched in 2011, it offers messaging and communication, payments, food ordering and various other social networking features. It truly is an app for everything and used by billions of people, primarily in China (under the name Weixin). Its everything-ness is impressive but also the source of criticism as the app is used for wider government surveillance and censorship under the Chinese regime.

Other apps in the conversation are Chinese payments app AliPay which also has ridesharing, appointment and travel booking features, and Southeast Asian apps like Grab and Gojek. They are equally impressive in their ubiquity, also offering a range of services such as payments, travel, food, and more.

Grab is a bit like Uber but with multiple added services on top, including one of the region’s first digital banks. It’s reportedly expecting revenue of $2.2 billion in 2023 and has grown significantly since its inception in 2012, although it’s still not profitable.

The origin of these apps also goes hand in hand with the socio-economic situation of the market they were launched in. One commentator put it like this; “What happened in a lot of Asian markets is that the mobile web was synonymous with the rise of the web for many people.” An app that did everything made sense for people that primarily accessed the internet via their phones as opposed to a Western audience who until recently have primarily been led by their desktop browser.

Overo echoed this sentiment saying that banking the unbanked has and may continue to be one of the key drivers behind such an app. “If you look at the underbanked and the unbanked segments, whilst there may be low penetration from a banking perspective, there is a high penetration from a mobile phone or smartphone perspective. And so, for finance, the main channel for it to be delivered to those segments is through the smartphone.”

The question for users in the UK, Europe, America and beyond is whether any of this is wanted and even whether it is possible.

The struggle for a Western super-app

One of the primary obstacles to X.com ever emulating something like WeChat is the fact that for many of the services offered by the Asian apps above, whether that’s banking, payments, or grocery shopping, there are already popular and established incumbents that many Westerners would rather turn to.

Even the growing slate of challengers, themselves becoming more established, would surely be preferable to a catch-all app from an entirely different industry.

According to the Rapyd survey, when asked who they would trust to deliver a super-app, 57% of UK respondents opted for their bank. They were much less keen on the idea of something from big tech companies like Amazon, or Apple.

Meta and Zuckerberg have made several attempts at incorporating multiple features into their apps with the addition of marketplace and games to Facebook or the shopping facility in Instagram, but these don’t quite make them a super-app.

Most major endeavours have taken place in the fintech space. The largest European neobank Revolut, has added a marketplace for booking tours and attractions, where users also get cashback on their bookings. This is on top of a growing range of financial services including crypto and equity investment and bundled items like insurance and airport lounge passes.

Klarna has explored adding a shopping feature to their app, and the crypto exchange Coinbase, have made their own super-app intentions known, with CEO Brian Armstrong saying “we want to be that super app, but it’ll be based on decentralised protocols, not just money but decentralised social, messaging, merchants accepting NFTs out there, simple interfaces for DeFi.”

Even traditional banks in the UK like NatWest or Barclays have made admirable efforts to catch up with challengers by offering an improved mobile experience and a wide range of products and features within their app.

But whether any of these are actually super-apps is up for debate.

Many are simply repurposing the white labelled products they already offer into a marketplace or directory of mini apps. If users still need to manage multiple accounts or open a portal to access a unique product then it’s not creating the frictionless, integrated user experience that should be at the heart of a super-app.

In a Forbes article on the topic, banking writer Paolo Sironi is quoted as saying fintech companies have “wrongly conceived super-apps as marketplaces of white-labelled opportunities instead of engagement mechanisms to activate clients through their journeys. A financial marketplace is not a super app.”

Overo agrees. “Successful super apps don’t just bundle services. They’re trying to combine them in a way that’s going to offer what I believe is a more enhanced value-add to the end user.”

Will it be allowed?

The other main challenge is whether or not something like this will get past the regulator.

Big tech companies like Apple or Google are arguably better positioned than anyone to deliver such a product. These ‘super companies’ have conquered multiple verticals and will have control over some users’ entire digital and tech ecosystem. But they have so far shunned the idea of a super-app even if Apple has now ventured into financial services to great acclaim.

But any attempts for a social media or big tech driven super-app could be curtailed by a regulatory and political landscape that keeps an increasingly close eye on these companies. Justifiable concerns about data protection and how much of it is transferred between parties could prevent some consumers from jumping on the bandwagon, something that was reflected in the survey results above.

Jeremy Baber, the CEO of payment card provider Lanistar, commented on Europe’s role in the super-app race saying, “Regulators in the US and Europe have become increasingly critical of companies developing super-apps, stating that they heighten the risk of data breaches and store more personal data to facilitate the delivery of their services. Super-apps must also be well-guarded to prevent cyber security breaches. Furthermore, users would lose access to multiple real-life services and digital applications if their accounts are lost.”

There is clearly some enthusiasm from the consumer for a ‘swiss army knife’ app. The streamlining of banking services pioneered by the challengers could easily be furthered by integrating more and more services into one app, that naturally flow from one to another.

But the truth is a functioning super-app in the West could be a long way off. It may be that super-apps of the future will tackle a few different but related services rather than multiple verticals at once but over time these could get closer and closer together. Consumer behaviour is constantly changing so it’s only likely that the tech will change to serve it.

People In This Post

- Cytora and Quarticle Partner to Embed Cloud-Native GeoIntelligence into Commercial Insurance Workflows Read more

- Integrity Viking Funds Modernizes Investment Accounting Infrastructure with FIS Investment Accounting Manager Read more

- The True Cost of Fixed Income E-Trading: Transparency, Margins and Market Structure Read more

- KAST Appoints Former Binance Global Communications Leader Brad Jaffe as Chief Communications Officer Read more

- Karby Leggett Appointed Head of Digital Assets for GCNA, South Asia and ASEAN Read more