Breaking News

Revolut => Open banking? Yes in the U.K.

Possibly biggest European banking and money transfer app, Revolut, claims approx. 10 million customers. Now Revolut partnered with open banking API provider TrueLayer to add bank account aggregation features to its app.

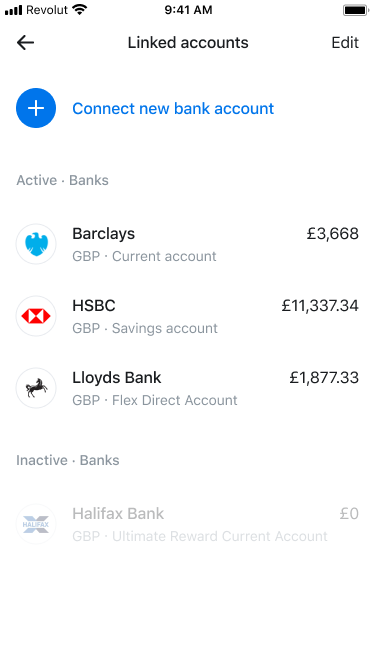

The new feature that Revolut’s U.K. customers can use now is to connect their external U.K. bank accounts to Revolut. That makes them able to see all of their bank balances and transactions.

Revolut’s move to roll out aggregation features has the potential to help change that. Or so says TrueLayer co-founder and CEO Francesco Simoneschi.

“With the launch of our new Open Banking feature, U.K, customers can now view and manage multiple external bank accounts, enabling them to interpret their day to day spending across all of their accounts,” adds Joshua Fernandes, Product Owner for Open Banking at Revolut.

“We’re delighted to see that new legislation such as Open Banking is changing our financial landscape for the better, and I’m proud that Revolut and TrueLayer are at the forefront of this experience”. says Joshua.

Francesco Simoneschi, CEO, TrueLayer, adds: “Revolut has a huge, rapidly growing customer base that will now benefit from gaining a 360 view of their financial health. This is exciting because for years, people haven’t been getting enough value from traditional banks – paying more than they should on interest and not benefiting from a unified view of their finances.”

- Bluefin and Basis Theory Partner to Enable Unified Tokenization Across Digital and In-Person Payments Read more

- Invest Bank and AUTON8 Build Partnership to Drive Digital Resilience and Banking Agility Read more

- ING’s AI Roadmap: Platform, People, and Agentic AI Read more

- UK-fintech Provided Over £17.5m in Emergency Wage Advances to More Than 55,000 Employees in the Last Year Read more

- TreviPay Announces AI-Powered Growth Center to Help Enterprises Predict Buyer Behavior and Drive B2B Sales Read more