Breaking News

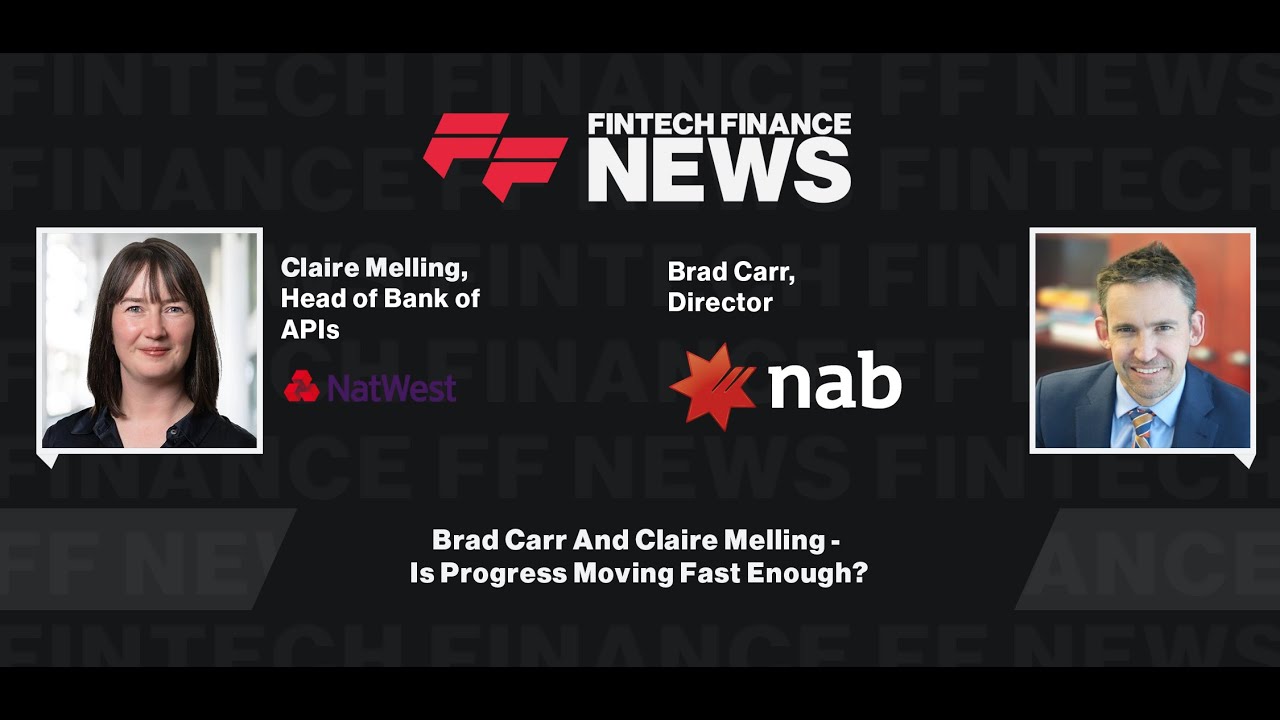

Brad Carr And Claire Melling – Is Progress Moving Fast Enough?

We met up with Brad Carr, Director at NAB, and Claire Melling, Head of Bank of APIs at NatWest, to discuss whether progress in banking is moving fast enough.

NAB (National Australia Bank) is a financial institution that provides banking, investment, and insurance services, serving individuals, businesses, and institutional clients in Australia. NatWest and NAB have published a jointly authored white paper exploring the common threads that bind both Australia’s Consumer Data Right (CDR) and the UK’s Open Banking regime.

“In Australia, the adoption of action initiation, as you’ve already done in the UK, will be a significant catalyst in our market. When we go from that purely read-only scenario to actually being able to initiate payments, I think that’s going to do a lot to really drive the uptake.” – Brad Carr

“When something new is launched, we overestimate the impact in the short term and underestimate it in the long term. When we look at contactless cards, that’s a good example of where we’ve done that. For context, in the UK, the OBI released a report last year that about 10% of the UK adult population is now using open banking, and payments are growing by 10% month on month.” – Claire Melling

- The Business Show Miami 2026 Delivers Knowledge, Connections, and Solutions for South Florida Leaders Read more

- BirdsEyeView Launches ‘AI Data Scrubbing’ for Large-Scale Hazard Modelling Read more

- CIBC Innovation Banking Provides Growth Capital to Gradient AI Read more

- ACI Worldwide Launches Card Payments on Cloud-Native ACI Connetic, Advancing Unified Payments Platform Read more

- Raisin Launches Its Savings Platform in Italy, Entering Europe’s Third-Largest Deposit Market Read more