Breaking News

Source sees More than USD 500 Milllon flow into its Gold ETC as Investors ‘Take out Insurance’

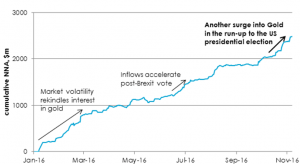

Source, one of Europe’s leading ETF providers, saw inflows of more than US$500 million into its Source Physical Gold ETC between 1 October and 8 November this year. Chris Mellor, Executive Director, Equities Product Management, commented: “Markets may have been wrong-footed by Donald Trump’s victory but investors in Source Physical Gold were clearly taking out insurance against market volatility in the run up to the US elections.

“We’ve also seen more than USD 2.4 billion inflows into the product since the start of the year – more than any other Gold ETC in Europe.

“It is likely there will be further uncertainty around the Italian referendum early next month and French and German elections next year. That is before we even consider what will happen in the US in the coming months and years. In such an environment, the advantages of a large, liquid and low cost product are very attractive.”

Source Physical Gold has low fees, low trading costs and high liquidity, with over USD 20 million trading each day on average across European exchanges*and more than USD 4.5 billion of assets.

Net new assets in Source Physical Gold (USD million)

Data: Source/Bloomberg, 8 November 2016. Past performance is not a reliable indicator of future performance.

*Based on average amount traded over last 3 months. Data: Bloomberg, 8 November 2016.

- Trading Minds Online: How Fintech Education Shapes the Next Generation of Market Players Read more

- Finnovex Saudi Arabia 2025 – Post-Show Highlights Read more

- Modernising Payments: How Are Banks in EMEA Shaping Up? | Part 3 | Volante Technologies Read more

- Building True Resilience in the UK Payments Ecosystem | Part 7 | Bottomline Read more

- Cheaper, Faster… Riskier: Over Half Of Brits Plan To Use ChatGPT For Completing Their Tax Returns Read more