Breaking News

UK Fintech Will Be a £20 Billion Sector in 5 Years: The State of Fintech

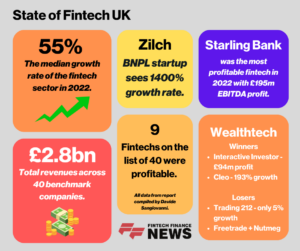

The UK Fintech sector is showing mostly positive growth according to recent findings from investor and commentator, Davide Sangiovanni. His data, gathered from annual reports submitted by 40 of the biggest companies in the sector, give a good picture of the current state of UK fintech.

The findings show a median growth rate of 55% across the sector in 2022 compared to the previous year. The total revenues for this set of companies was £2.8 billion in 2022 and according to Sangiovani if the sector continues at this rate it could well be worth £20 billion in 5 years. The average growth rate was 118%, skewed slightly by the ironically named Zilch. They grew by an astronomical 1,400% in the surging BNPL category, and boast over 3,000,000 customers globally.

The segment with the most growth was those in the SME and consumer lending category. Starling, Tandem and Zopa were all mentioned, with Starling posting an annual profit (EBITDA) of £195 million, the highest in this list. Allica bank, founded in 2011, was the neo bank that experienced the most growth and was one of only 9 companies on the list that reported being profitable by the end of 2022. Other big players like Monzo, Tide and Monese are not yet profitable although Monzo did have a growth rate of 88%.

Another profitable neo bank was Revolut. However, the figures included are from their 2021 reports, belatedly submitted at the start of this year, not their 2022 reports which are also yet to be submitted. The European neobank, Europe’s largest, has been in the news quite a lot recently, not only for that but also because they are yet to file a formal US banking licence application, despite stated ambitions to do so. It was also recently reported that they have struck a share deal with major investor SoftBank in order to remove a significant barrier in their quest for a UK banking licence, something that has so far eluded them.

When asked why they had failed to submit their accounts on time, a Revolut Spokesperson told us, “we have received an extension for the filing of our 2022 accounts. We look forward to announcing our 2022 audit and annual report in due course. We continue to be pleased with the growth of the business, new products, higher user numbers and volumes, and increased financial metrics that result.” And that “The late filing of our 2021 accounts had a knock-on impact on the 2022 audit timeline.”

Other findings included the lower-than-expected growth of companies providing banking infrastructure. Overall, revenues were low and none are profitable although ClearBank who did experience better than average growth in 2022 reported sustained monthly profitability since November 2022, posting a £5.9m pre-tax profit in H1 2023 suggesting they are on track to receive annual profitability for the first time.

There were also mixed results for players in the wealthtech and investment space. In an increasingly crowded market, the winners are CleoAI and Moneybox as far as growth is concerned, although neither were profitable. Of the ones that were, Interactive Investor saw revenues of over £182 million and a growth rate of 34.5%. Trading 212, the first UK retail broker to offer commission free trading, also reported profitability but with only 5% growth vs 2021 and higher operational costs. Others in the space such as Nutmeg and Freetrade have a growth rate lower than 30% and are highly unprofitable. Can they turn it around this year?

At the bottom of the pack 3 companies had a negative growth rate. They included Crowdfunder Seedrs which provides a popular launchpad for a lot of fintechs including fellow travellers in this list, Cushon and Tandem.

Sangiovanni’s findings show a sector that is still largely in startup mode; relying mainly on funding and not yet making a profit. But the growth figures are positive. I spoke to him to get his thoughts on what they show us.

Sangiovanni, who invests in “early stage, community-based consumer-focused companies” through his company Graffiti Ventures, said that he compiled the list as part of his investment analysis into the fintech sector.

Ultimately his perspective is positive. “The 2022 revenues for the sector (with my 40 companies benchmark) are almost £3 billion, a relevant number considering that 90% of the companies didn’t exist 10 years ago.” Indeed, it is impressive growth, even in the face of economic uncertainty and most of the companies continue to grow “at a very strong rate (median 55%, Average >100%).”

“If you assume a compounding growth rate of 50% for the next 5 years, we can assume that in 5 years the revenues of the UK fintech sector will be well over £20 billion.”

There’s a lot of work to be done across the sector to find ways of sustaining profit, whether that’s in banking infrastructure, savings, lending or investing, but these are promising signs indeed. Despite the unknowns, the trend points upwards and there is plenty of room for growth.

People In This Post

- How Many Finovates Have You Done? Read more

- Paytently Strengthens Fraud and AML Capabilities with SEON Partnership Read more

- Onics’ Take on the Future of Insurance Engagement Read more

- Backbase and Plaid Partner to Bring Open Finance to AI-Powered Banking Read more

- How ING Sees AI Changing Banking: Humans for Advice, Agents for Speed Read more