Breaking News

EXCLUSIVE: “iConsumer” – Jorissa Neutelings, ABN AMRO in ‘The Fintech Magazine’

ABN AMRO styles itself as ‘a personal bank in the digital age’. It’s a great strategy when your customers are human, but that might not always be the case! Chief Digital Officer Jorissa Neutelings tells us how AI is shaping CX now and in the future

“What if your customer is a robot?’ sounds like an existential question, right up there with ‘do androids dream of electric sheep?’. But it’s one that financial institutions and payment services providers might well have to devote more time and resource to answering.

A traditional Google search for guidance reveals very little. Aside from a few philosophical debates number of articles addressing the practicalities of dealing with robot personal assistants in many, if not all of consumer’s future interactions, is practically zero.

However, ask Google AI that very same question and it’s clearly got opinions.

In short: “When dealing with a robot customer, focus on clear, concise communication, using precise language and avoiding ambiguity. Ensure the robot understands instructions and can execute tasks effectively, while also being mindful of its limitations… Avoid jargon, slang, or complex sentence structures that could confuse the robot. [And] Don’t expect the robot to understand complex emotions or nuances in language.”

This robot has clearly thought about the way it wants its artificially intelligent cousins to be treated and how they want the customer experience to be built around them – perhaps informed by the 16.4 billion or so poorly prompted searches it has to deal with every day from illiterate humans.

So, are we in the realm of science fiction, or aren’t we? Dutch bank ABN Amro is already considering this scenario when looking at the consumer landscape in the years ahead.

“What I already see in our ecosystem is that the customer will not always be a human but a bot, buying services and products for many customers,” says ABN Amro Chief Digital Officer, Jorissa Neutelings. “In the future, every one of us will have a personal assistant – or many – who does the business for us in a digital landscape.”

Does that mean that developers are already looking at robot-on-robot customer service – which is precisely the opposite to what they’ve been endeavouring to achieve with human-robot conversations?

As ‘a personal bank in the digital age’, ABN Amro is tackling that conundrum head-on, acknowledging the need to embrace the opportunities of technological advancements, while still understanding that customers (for as long as they remain human) feel a very real need for individual and personalised customer service.

Neutelings says that using the wealth of data available to the bank to personalise customer experience and improve the quality of interfaces, is how it’s countering user frustration.

“What you see is irritation grows with customers if the service or the product is not especially meant for them as individuals. So hyper-personalisation, really using all the data we have, is really important. We have to ask ourselves, what do we know? What do we want to cater for? What kind of approach does that specific customer want?” says Neutelings.

“We like our tools, but tools alone will never create a great customer experience”

“A customer used to be just a bank account number. We didn’t necessarily know a lot about them. Today, we have more and more data that we can use to create one digital identity for a customer, so we can replicate the service they would have had at a branch where the head of that branch knew who they were, personally, and what kind of advice they needed.

“Next to that hyper-personalised approach, of course, genAI really helps us to proactively reach out on an individual level.”

It’s this combination, in fact, that’s improving the reputation of chatbots. Often portrayed as one of modern life’s more frustrating advances, many of today’s ‘conversational interfaces’ are beginning to interact more like a human, whilst still delivering all the efficiencies that come with artificially intelligent technology. Many are even programmed with a deprecating sense of humour – financial advice app Cleo excels at bot-human banter and users love it.

Banking (mostly) on the bots ABN Amro, which is the third-largest bank in The Netherlands and serves more than five million retail customers and 365,000 mortgages, insurance and loans. Crucially, Anna can identify a customer in just a few steps.

At the launch of Abby and Anna, Bobby van Groningen, IT Lead at ABN AMRO, said: “With the rapid introduction of generative AI, we anticipate that our customers are going to expect much more from a chatbot and we wanted to get ahead of that demand.”

“It’s all about how well the interface performs,” Neutelings explains. “If a customer has to pose a question twice, then the chatbot’s out and they will immediately want to speak to a person. On the other hand, if the interface is more human and they can talk to it like they talk to their best friends, ask questions and get a response, we see a lot of positive feedback. “Anna understands you and knows exactly

how you feel from your voice – if you’re angry, for example – and will respond empathetically. She also knows what you need because she has all the data at hand.”

In some circumstances, Neutelings says, the bank has even seen a clear preference for companies make the mistake of only starting to be customer-driven once there’s a problem financially or they receive a lot of complaints or things go wrong.

“Digital transformation is not solely about the digital,” she continues. “It’s not about technique. Many companies try to digitalise without a great perspective and vision of what kind of customer experience they want to provide. For us, they go hand in hand.

“At our bank, we have a future view of the expected customer experience that we want to cater for. And we call that friction-free value, which really aligns everything we need to do. So, we choose very carefully, so that our digital transformation caters for a situation, the needs and the expectations of a customer, and not the other way around.

“We like our tools, but tools alone will never create a great customer experience.”

That’s something every user could agree with… unless, of course, you’re a robot!

This article was published in The Fintech Magazine Issue 34, Page 15-16

People In This Post

Companies In This Post

- Ripple Redefines Payments with End-to-End Stablecoin Platform and Global Customer Momentum Read more

- Alkami Now a Nacha Preferred Partner for ACH Experience, Fraud Monitoring, and Risk and Fraud Prevention Read more

- What Turned Storm Chandra Into a UK Flood Crisis Read more

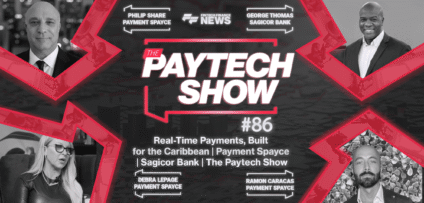

- Real-Time Payments, Built for the Caribbean | Payment Spayce | Sagicor Bank | The Paytech Show #86 Read more

- Pleo: From Hindsight to Finance Foresight Read more