Breaking News

What happens to your Bitcoin when you die? World’s first Cryptocurrency Will product is launched

- Coincover launches world-first Cryptocurrency Will product, in response to 4 million Bitcoins (worth c. Thirty Billion Dollars,) lost as a result of people dying without adequate plans in place

- Launched in partnership with leading wallet provider BitGo

- Based in the UK, Coincover is a fully authorised intermediary regulated by the Financial Conduct Authority (FCA) and underwritten by Lloyds of London

Today, Coincover, the leading cryptocurrency protection and insurance company announced their new product, Cryptocurrency Wills. Providing a unique and dedicated solution to cryptocurrency estate planning, the product – which is a world-first – solves one of the key issues preventing cryptocurrency going mainstream: what happens to Bitcoin when you die?

Bitcoin is like no other asset; without a robust retrieval mechanism once it’s lost, it’s lost forever. It is estimated that around 4 million Bitcoins (worth around Thirty Billion Dollars,) have been lost as a result of people dying and without adequate plans in place.

Coincover is the only solution on the market to this problem. Coincover will help executors and beneficiaries retrieve cryptocurrency funds in the event of the owner’s death with its Cryptocurrency Will Kit.

Coincover has partnered with BitGo to offer their Will product. BitGo is the market leader in institutional-grade multisignature hot wallets (i.e. online, internet enabled wallets), processing 20% of all global Bitcoin transactions, and $15 billion per month across all cryptocurrencies. Customers purchasing the Cryptocurrency Will Kit must store their cryptocurrency in a multi signature BitGo wallet. Multisignature wallets require at least two keys (ID numbers that give you access to your Bitcoin), to authorise a transaction, to ensure heightened two-factor authentication security.

Mike Belshe, CEO of BitGo, comments: “Transparency and accuracy is essential for building trust in the market so it’s critical for clients to understand under what circumstances their investments are insured and to what extent any loss would be covered. In partnership with Coincover, we are not only providing comprehensive coverage, we’re being completely transparent about the terms of our coverage.”

How the Cryptocurrency Will Kit works:

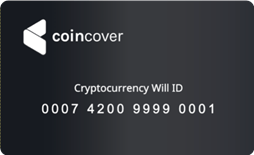

Coincover’s Cryptocurrency Will Kit can be brought from e-commerce giant Amazon as of today. The Kit contains information, a physical, stainless steel ID Card with a unique ID number (for you), and Notification Cards with ID numbers (for your loved ones or executor contacts).

The Cryptocurrency Will requires just three simple steps to set up:

1. Answer some simple questions and register your ID on the wills.coincover.com website to activate your Cryptocurrency Will

2. Secure your Bitcoin by setting up an online BitGo Cryptocurrency ‘wallet’ to store it in

3. Distribute the Notification Cards provided in the Kit, to your executors and loved ones for safe keeping

When you die, your loved ones or your executor contacts Coincover, and gives the Unique ID number provided on the Notification Card, along with a death certificate corresponding to the deceased. Coincover will investigate and then retrieve the funds.

David Janczewski, Co-Founder and CEO, Coincover, adds: “As Bitcoin becomes more mainstream and its value continues to increase, considering how to manage it as part of an estate planning exercise is becoming increasingly difficult. Many people don’t know that unlike physical assets which form part of an estate on death such as savings, property, pensions and investments, you can’t get at cryptocurrency, unless you have the key or password to it. There’s no bank manager to ask, and no one can break in for you. That’s why so many billion Bitcoins are lost when people die each year. Our Cryptocurrency Wills product meets this gap in the market.”

Along with BitGo, we act as the custodian of the back-up key and only the two together, in the event of a death, can unlock the wallet and retrieve the funds. So your loved ones can benefit from your cryptocurrency investment after you pass away”.

Coincover trusted partners and accreditation

Coincover has also partnered with Harrison Clark Rickerbys, a top 100 UK law firm, to enable their clients to supplement their main will with a Cryptocurrency Will. There is no need for their clients to hand over confidential keys or passwords. Coincover takes care of the custody aspects leaving HCR to take care of their clients’ wishes.

Reinforcing its credibility, Coincover is FCA approved and is backed by several Lloyds of London insurers who agree that the Coincover solution is the best and only way to hold funds online whilst being totally sure that they are protected against theft and loss.

- Trust Travel, a TUI Brand, Partners With Qover to Deliver Seamless Travel Protection at Booking Read more

- New Partnership Introduces First-of-its-Kind Model To Democratise Olympic Sailing Read more

- Offa Outpaces High Street Banks on Speed With Islamic Mortgage Launch Read more

- Engine by Starling Enters Fourth Global Market With New Zealand’s SBS Bank Read more

- New Visa Study Shows 9 out of 10 Ukrainians Want Their Payments to be Protected by Biometrics Read more