Breaking News

Two Expert Comments on SMR, Banks And Benchmarks

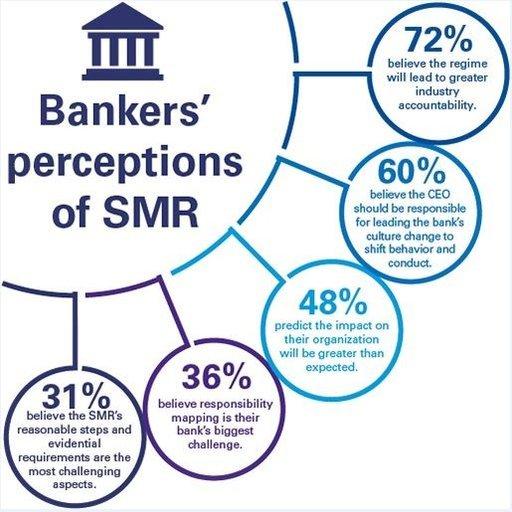

Chrisol Correia, head of international AML at LexisNexis® Risk Solutions comments on the lists of accountable individuals under the upcoming Senior Managers Regime (SMR)

“Recently, banks submitted their lists of staff that will be held responsible under the provisions of the Senior Managers Regime (SMR), creating additional pressure for financial crime compliance officers throughout the UK.”

“The SMR effectively holds compliance staff accountable to the same risks and responsibilities as the most senior management – but without the same level of reward. Last year our survey with the British Banking Association (BBA) found that more than half (54 per cent) of compliance professionals would choose another career path if given the opportunity in light of increased personal liabilities; unsurprising when there is risk of a custodial sentence. A skills shortage in this area would be highly disruptive due to the importance of the compliance officer role to not only individual banks, but the broader financial system.”

“The SMR and scheduled increase in criminal penalties growth in personal liabilities could make it more difficult for banks to recruit compliance officers. The global banking industry must ensure that compliance staff, who are under this increasing pressure to comply, are supported with accredited training. Compliance professionals also need to be equipped with effective resources to identify non-compliant and potentially illegal activity ahead of time, including the latest data and analytics tools, in order to mitigate the risk of becoming non-compliant and the serious consequences that follow.”

Haydn Lightfoot, Associate Partner at financial services consultancy Crossbridge, comments on the list of accountable people under the upcoming Senior Managers Regime (SMR).

“Many senior bankers will today be worried by the real risk they could face disciplinary action if the controls for which they are responsible fail to catch rogue colleagues breaking the law, and the regulator can subsequently prove these controls fell short of what should reasonably be expected. Whilst the onus is no longer on the individual manager to prove they took all reasonable preventative steps following the FCA’s removal of the presumed responsibility clause, bankers remain under pressure.

“Bankers could be given some reprieve, as it may be difficult for the regulator to prove beyond reasonable doubt that a top banker had not taken every reasonable step to prevent criminal activity. In order to create and maintain a minimum standard of compliance, the regulator should issue an industry-wide set of benchmarks which banks can be assessed against. This would provide real clarity and help the regulator rebuild public trust in our banks.”

- DIFC’s Dubai FinTech Summit Expands Globally with Pakistan Digital Authority Read more

- GoldenPeaks Capital Secures Largest PPA Deal in Hungary With Hankook Read more

- Volante Technologies: AI, Crypto, and Modern Banking Innovation Read more

- Payment Spayce and Sagicor Bank: Innovating Fintech for the Caribbean Market Read more

- Top Companies Supporting Former Workers with German Pension Refunds Read more