Breaking News

Regulation gives boost to card acceptance in Europe

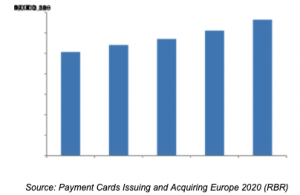

According to RBR’s new report, Payment Cards Issuing and Acquiring Europe 2020, regulatory factors are playing a key role in increased card acceptance; the number of card-accepting outlets grew by 9% during 2018, to reach a total of 13.3 million.

One country where growth has been particularly strong is Russia. Here, legislation requiring merchants with an annual turnover of over €540,000 to accept card payments came into force in 2017, driving a 22% surge in the number of outlets where cards could be used in 2018. In 2020 the threshold was lowered further to €270,000, and the Russian government is set to make card acceptance obligatory at all outlets by 2023.

Meanwhile, the number of Greek merchants accepting card payments has increased fivefold since 2014, fuelled by limits on cash usage and the government mandating card acceptance for certain business categories, as part of wider initiatives to improve tax collection and encourage cashless payments.

RBR’s report shows that Poland and Ukraine also saw strong growth, with a 20% rise in outlets, driven by increasing support from governments and industry players in promoting cashless payments. These efforts have encouraged more customers to pay regularly by card, and they increasingly expect to be able to do so, even for small-value payments – merchants who do not accept cards risk losing business as payment preferences change.

Number of Merchant Outlets in Europe, 2014-2018 (thousands)

Huge increases in number of contactless terminals

Contactless technology is increasingly prevalent across Europe and according to RBR, the number of contactless-enabled terminals across the 25 European countries covered rose by a quarter in 2018, to 15 million. Indeed, contactless card payments are now accepted at three quarters of the region’s terminals. Such progress can largely be seen as a result of Visa and Mastercard mandating European terminals to be contactless-enabled by 2020. Contactless is popular not just with customers, but also with merchants, who prize transaction speed. Even in the UK, where contactless technology is well-established, the number of these terminals rose by 25% in 2018.

RBR’s research shows that the introduction and expansion of contactless technology, coupled with new regulations, have served to shift consumer behaviour and expectations. Continued growth in the number of card-accepting outlets which enable contactless payments, in response to increasing customer demand, will lead to further rises in both the number and volume of acquired payments across Europe in the years ahead.

Thomas Madden, who led RBR’s Payment Cards Issuing and Acquiring Europe 2020 research, said: “Regulations have boosted card acceptance while customers increasingly see the benefits of card payments – using contactless technology where possible. There still remains potential for growth, however, as regulatory measures gain further traction and new retail sectors begin accepting card payments”.

- QuantHouse Selects BMLL to Complement Real-Time Data Services With Historical Order Book Data Read more

- AffiniPay Expands Into Puerto Rico Read more

- The Complex E-commerce Value Chain Explained | Nexi | Nexi Roadshow: MPE Berlin Read more

- Zywave Launches New Cyber Quoting Solution with Simplified Data Collection Read more

- Mastercard Launches Mobile Virtual Card App to Simplify Travel and Business Expenses Read more