Breaking News

Q1 Figures From Beauhurst Give the Clear Picture of Equity Crowdfunding Market

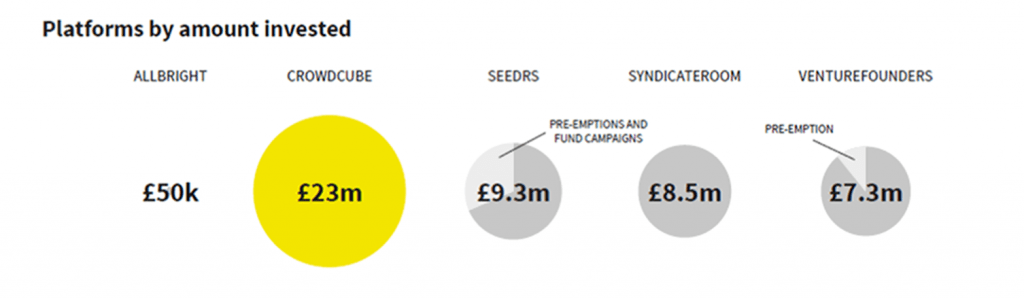

The crowdfunding index (attached) from the latest edition of Beauhurst’s, The Deal, shows that crowdfunding saw 11% growth in deal numbers with £45m invested over 80 deals, bucking overall equity investment into UK’s high-growth businesses in first quarter which remained stagnant.

Crowdcube UK’S No1 equity crowdfunding platform by amount invested

Source: Beauhurst

Commenting on the release of Beauhurst’s quarterly report on the Crowdfunding industry, The Deal, Luke Lang, co-founder of Crowdcube, said: “The latest figures from Beauhurst released this week tell us what we have known for a long time; that when it comes to investment raised we’re blowing the competition out of the water by a substantial margin.

“Capital successfully invested is the key measure of platform performance for savvy entrepreneurs and astute institutional and private investors rather than over simplistic data based on deals completed, which can be highly misleading. For us, this is more important than the number of deals done as it reflects how Crowdcube and the market is maturing.

“According to AltFi Data we have achieved the highest internal rate of return (IRR) in equity crowdfunding to date and have been responsible for the most number of exits our sector, we’re currently beta testing our secondary market platform, and completed the first on-platform secondary share trade earlier this month.”

Crowdcube recently announced its second consecutive record quarter putting the business on a trajectory to beat last year’s investment record of over £80 million raised, further proving that the sector is now a mainstream funding option.

- Onics’ Take on the Future of Insurance Engagement Read more

- Backbase and Plaid Partner to Bring Open Finance to AI-Powered Banking Read more

- How ING Sees AI Changing Banking: Humans for Advice, Agents for Speed Read more

- Volante Technologies: Why Payments as a Service Wins Read more

- Who Actually Wins Finovate Europe? Read more