Breaking News

PwC: How FinTech is shaping financial services

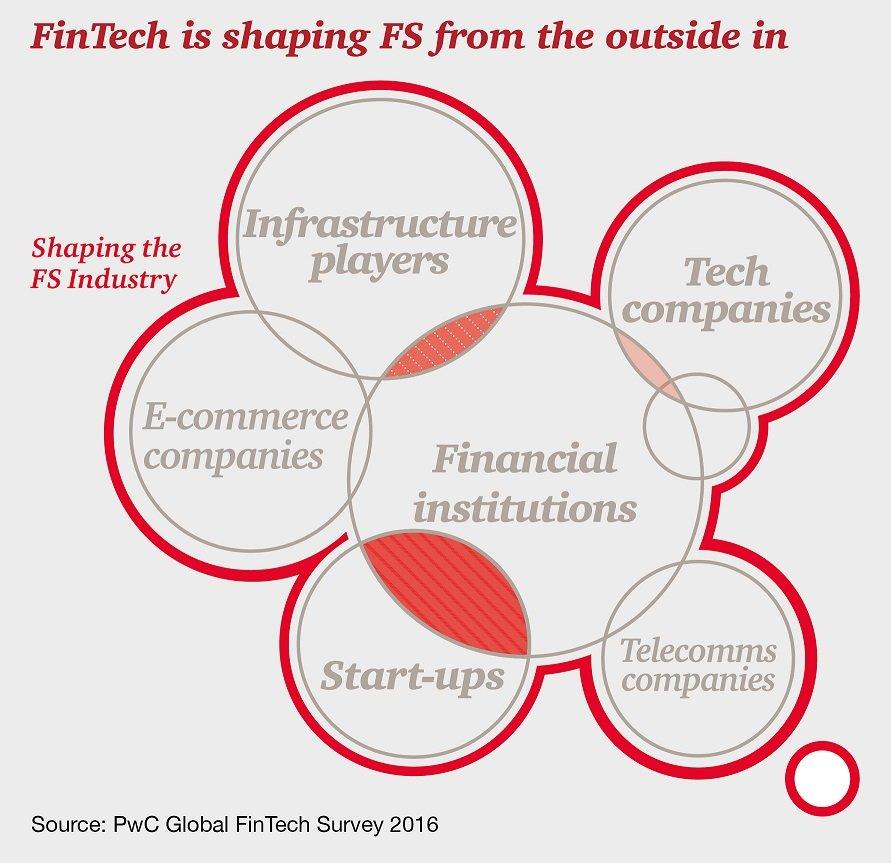

PwC reveals juicy findings in its new fintech survey. In its new survey-powered fintech white paper, PwC found that financial services incumbents believe that 23% of their business could be at risk due to fintech innovation while fintech professionals believe that they can snag 33% of traditional financial services business by 2020. That differential is significant, but the tastiest morsels are related to a “second wave” of disruption focused on Asset Management and Insurance. According PwC, 74% of Insurance executives and 51% of asset managers believe that their sector is the most likely one to be disrupted by fintech over the next five years (Page 7). Those are big numbers, and yet, only 43% of Insurance executives and 45% of asset managers want to make fintech a core element of their strategy (Page 23). That leads us to conclude that while many professionals in those verticals believe that disruption is coming their way, a significant percentage would prefer to act like modern-day Neros. Instead of fiddling, perhaps these executives should be working on strengthening their empires.

- Cheaper, Faster… Riskier: Over Half Of Brits Plan To Use ChatGPT For Completing Their Tax Returns Read more

- WorkFusion Raises $45 Million in Funding to Fuel Growth for Agentic AI for Financial Crime Compliance Read more

- AI-Powered E-commerce, Stablecoins and Local APMs: Emerging Trends Headline EBANX’s Payments Summit in Mexico Read more

- Second Day of Money20/20 Middle East Unveils Next-Gen Solutions at the Region’s Largest Ever Fintech Gathering Read more

- United Gulf Financial Services Joins The Hashgraph Association and Exponential Science Foundation Adding $1M to Hedera Africa Hackathon Pool Prize Read more