Breaking News

One Trillion and Counting: Card Payments Reach Unprecedented Scale Despite Competitive Pressure

New research from Datos Insights reveals that card purchases have surpassed one trillion globally for the first time, driven by expanding use cases including salary payments, e-commerce and everyday spending

Card purchases surpass one trillion worldwide despite growth slowdown

Cardholders worldwide made 1.1 trillion purchases worth US$ 45.5 trillion in 2024, having grown by 12% and 2% respectively since the previous year. However, despite reaching this milestone, growth has slowed from 15% and 4% in 2023, when COVID-19 pandemic recovery was still ongoing in some markets.

Prepaid leads growth as BNPL challenges credit cards

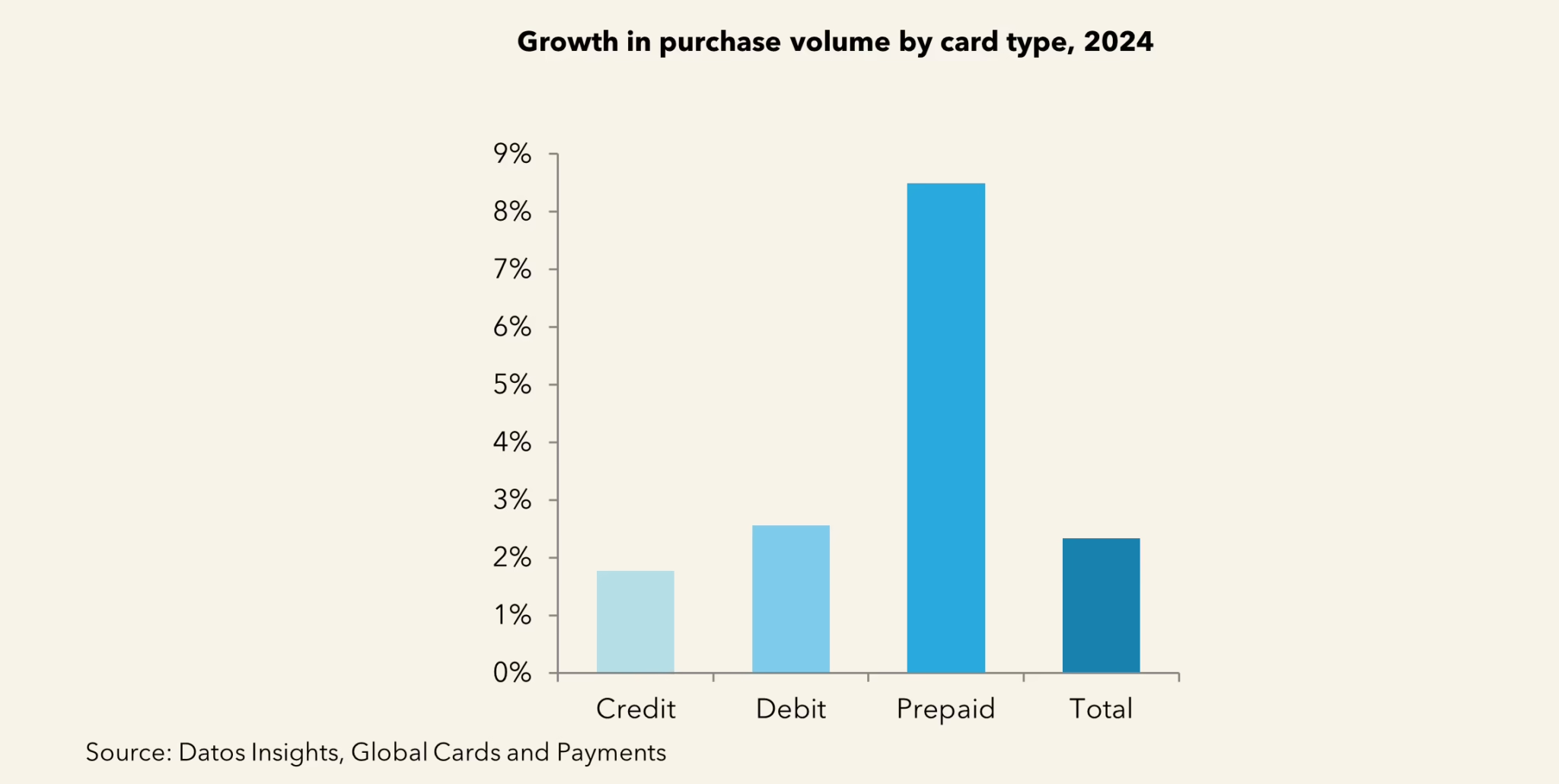

Growth in volume was strongest in the prepaid sector. Although such cards are growing from a much lower base than credit or debit cards – which are much more established – their growth is still significant because of the increasing number of use cases they have. Prepaid cards are becoming more widely used for salary payments, e-commerce, travel and spending among young people.

Meanwhile, debit cards continue to replace cash for everyday, low-value purchase, especially in the Americas and parts of Europe. Credit cards saw the slowest growth in volume, largely due to an aversion to debt among some cardholders and the rising popularity and uptake of Buy Now Pay Later (BNPL) solutions.

Asia-Pacific decline masks 4% growth outside China

Asia-Pacific is the largest region by purchase volume, but also the only one to see a decline in 2024. China – by some distance the world’s largest card market – saw its volume fall by 3% due to debt aversion, dragging the regional total down by 2%. Excluding China, the Asia-Pacific volume grew by 4%.

The Middle East and Africa, home to a large number of developing markets with a major opportunity for cash displacement, was the fastest growing region at 11%, followed by Europe at 9% and the Americas at 5%.

Card payments forecast to grow as use cases expand

Card usage is forecast to continue growing through to 2030, albeit with regional differences. Growth in Asia-Pacific is expected to be more limited as cards are increasingly used for lower-value purchases.

Daniel Dawson, Cards and Payments Lead at Datos Insights said: “The trillion-purchase milestone demonstrates the enduring strength of card payments. While cards face competition from account-based alternatives, the diversification of use cases – from salary payments to travel to youth spending – shows that cards remain the payment method of choice for consumers worldwide. This breadth of application will continue driving growth for years to come.”

People In This Post

Companies In This Post

- ClearToken Launches Regulated Stablecoin FX and Tokenised Settlement on Canton Network with Three Institutional DAPs Read more

- Teciem welcomes Didier Bouillard as Chairman of Board of Directors Read more

- Granite Receives Financial Regulatory Approval to Launch USD Fixed Income Fund Read more

- Orca Fraud Raises $2.35m to Scale Real-Time Fraud Intelligence Across Emerging Markets Read more

- Payment Fintech Njiapay Closes $2.1 Million Seed Investment Read more