Breaking News

Nucleus Commercial Finance calls for fast support for businessesResearch undertaken just prior to Coronavirus hitting, showed that over 2.6 million UK SMEs predicted they would be out of business within a month if they were suddenly and unexpectedly unable to trade

With coronavirus already affecting businesses, new research from Nucleus Commercial Finance reveals that prior to the virus having an impact, nearly half of SMEs (47%) predicted their finances would keep them running for a month if they were suddenly and unexpectedly unable to trade. This means that 2.67m small businesses may already be struggling with their finances.

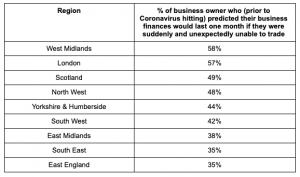

The data shows that a lack of financial buffer was an issue for businesses across the country with SMEs in the West Midlands and London more likely than those in any other region to identify their financial shortfall.

Despite nearly seven in 10 (69%) of businesses saying they were confident about their cash flow prior to Coronavirus, 6% would only be able to last a day, and a further 14% would be able to last up to a week should they suddenly and unexpectedly be unable to trade. With Coronavirus meaning that social distancing is in place and businesses in some sectors already struggling, business owners need the help that the government is promising now.

Chirag Shah, CEO, Nucleus Commercial Finance comments: “At a time of crisis, having access to finance is crucial. And, while recent developments, such as the £330bn of government-backed loans are welcome news for the industry, we need more clarity on how this will help in practice and which businesses it will support.

“Supporting UK PLC is vital to the growth of our economy, and in order to do this Government and industry must pull together and work collaboratively. At Nucleus Commercial Finance, we continue to work as we always have done, assessing every case individually. We’re working hard to process applications as quickly as possible, decisioning 95% of deals within 4 hours of receiving the full application, to keep up with the increased demand we’re seeing for funding.”

- Trust Travel, a TUI Brand, Partners With Qover to Deliver Seamless Travel Protection at Booking Read more

- New Partnership Introduces First-of-its-Kind Model To Democratise Olympic Sailing Read more

- Offa Outpaces High Street Banks on Speed With Islamic Mortgage Launch Read more

- Engine by Starling Enters Fourth Global Market With New Zealand’s SBS Bank Read more

- New Visa Study Shows 9 out of 10 Ukrainians Want Their Payments to be Protected by Biometrics Read more