Breaking News

Is Alibaba’s mega listing in Hong Kong the prelude to an exodus of Chinese technology stocks from US capital markets?

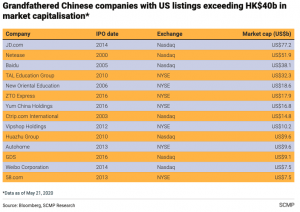

Some of China’s biggest new economy names, including Baidu, JD.com and Weibo, are among a small universe of companies who previously raised capital in the United States and could easily pursue their own secondary listing in Hong Kong thanks to a rule change by the city’s bourse two years ago.

The listing reform made it easier for companies with dual classes of shares – a structure favoured by technology companies such as Facebook and Google – and pre-revenue biotechnology firms to seek secondary offerings in the city. It came after the Hong Kong stock exchange lost out to New York in a race for Alibaba’s US$25 billion initial public offering in 2014.

The success of Hangzhou-based Alibaba’s listing in Hong Kong – the second-biggest globally this year after Saudi Aramco’s IPO and the third largest technology offering on record – could spur more Chinese firms to seek their own listings closer to home, according to bankers, economists and market watchers.

Sean Taylor, the chief investment officer for Asia-Pacific at asset manager DWS, said a secondary listing in Hong Kong would open up a new ecosystem of investors to Chinese firms that opted to list on American bourses and act as a potential hedge against the increasingly tense relationship between the US and China.

“It dampens the risk of waking up in the morning and having some China-US news go slightly bad or a tweet from [US President Donald Trump] and seeing all the [American depositary receipts] down,” Taylor said. “You’ve got a lot of good companies that are listed in ADRs in the US, but they’re completely domestically run Chinese businesses. They have nothing to do with global trade, but they get affected because of this in the US.”

Politicians on both sides of the aisle in Washington also have suggested limiting the ability of American pension funds to invest in Chinese companies and restricting the ability of Chinese companies to access the US capital markets until Beijing agrees to reforms.

“As the rivalry between China and the US becomes the new norm, it’s going to take some time for both countries to find a new equilibrium in their relations,” said Hong Hao, chief strategist at Bocom International, the securities and asset management arm of Bank of Communications. “Alibaba has very healthy financials, and it didn’t really need the secondary listing for refinancing. It’s preparing a backup solution as a responsible company.”

“The window of opportunity for a deal this year is rapidly closing if only because of the time required to arrange a meeting between the two leaders to sign an agreement,” Jon Harrison, managing director for macro strategy at research firm TS Lombard, said. “A phase one deal remains our central scenario, but timing is increasingly uncertain, while continued delay in reaching [an] agreement could start to become a drag on EM [emerging market] assets that are for the most part already pricing in a positive deal outcome.”

Bank of America economist Helen Qiao said there is rising concern among investors that the trade war is going to expand into “a capital war, an investment war or even a war on currency”, but there remains a good chance for a “skinny” deal between the world’s two largest economies.

“With some policy stabilisation and the US economic growth kind of weakening next year, we’re seeing the chance for better cooperation, not necessarily as much confrontation,” Qiao said. “That said, how much can you achieve in 2020, an election year? That is still a wild card out there.”

- Trust Travel, a TUI Brand, Partners With Qover to Deliver Seamless Travel Protection at Booking Read more

- New Partnership Introduces First-of-its-Kind Model To Democratise Olympic Sailing Read more

- Offa Outpaces High Street Banks on Speed With Islamic Mortgage Launch Read more

- Engine by Starling Enters Fourth Global Market With New Zealand’s SBS Bank Read more

- New Visa Study Shows 9 out of 10 Ukrainians Want Their Payments to be Protected by Biometrics Read more