Breaking News

International brands to drive European commercial cards sector

International brands to drive European commercial cards sector

The European commercial cards sector presents a considerable untapped opportunity for international brands, as the range of businesses using such cards expands.

Competition between schemes will intensify in the lucrative commercial cards sector

Commercial cards represent just 4% of all payment cards in Europe according to RBR’s study Commercial Cards in Europe 2015. RBR believes that the sector has significant scope for expansion as many businesses do not currently use commercial cards. Furthermore, the interchange fee caps that came into force in the EU for consumer cards in December 2015 do not apply to commercial cards, resulting in increased demand from issuers seeking to boost revenues. Card schemes will vie to create suitable products to cater for this growing demand. RBR forecasts that the number of commercial cards in Europe will reach 57 million by 2020, up from 45 million in 2014.

Fuel cards account for the highest share of commercial cards but will decline

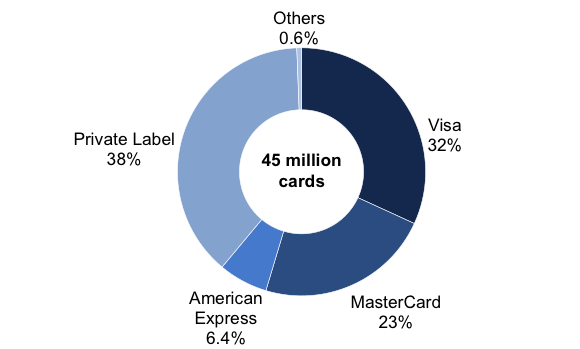

RBR figures show that private label fuel cards represent the highest share of commercial cards, with 38% of such cards in issue in Europe at the end of 2014. Their share of the sector is forecast to decrease to 28% by 2020 as internationally-branded cards are increasingly promoted and hold greater appeal for the majority of businesses because they can be used for a broader range of expenses.

Commercial Cards by Scheme in Europe, 2014

Source: Commercial Cards in Europe 2015 (RBR)

Visa’s strong position in the UK and France makes it the largest international scheme in Europe

Visa, MasterCard and American Express account for virtually all internationally-branded commercial cards. Visa’s strong position in the UK and France – two of the largest markets for commercial cards – makes it the largest international scheme overall, ahead of MasterCard and American Express. It is interesting to note, however, that MasterCard cards are more prevalent than their Visa counterparts in more of the countries surveyed in RBR’s study. MasterCard’s share rose by two percentage points in 2014, thanks to strong performances in a number of markets, including Spain, Sweden and Turkey.

American Express continues to make a big play on the commercial rather than on the consumer cards sector. There is a standardised process of issuing American Express commercial cards in multiple countries, which tends to be favoured by large multinationals, especially in Germany.

Looking ahead, international schemes will increase their share of the European commercial cards market at the expense of private label fuel cards, which have traditionally accounted for the largest proportion of such cards. RBR’s study shows that there is much to be gained for schemes that can demonstrate the profitability of their products, based on interchange, financial support and other factors.

- Bluefin and Basis Theory Partner to Enable Unified Tokenization Across Digital and In-Person Payments Read more

- Invest Bank and AUTON8 Build Partnership to Drive Digital Resilience and Banking Agility Read more

- ING’s AI Roadmap: Platform, People, and Agentic AI Read more

- UK-fintech Provided Over £17.5m in Emergency Wage Advances to More Than 55,000 Employees in the Last Year Read more

- TreviPay Announces AI-Powered Growth Center to Help Enterprises Predict Buyer Behavior and Drive B2B Sales Read more