Breaking News

OBL Publishes Open Banking Standard V4.0 to Assure Future Ecosystem Growth

Open Banking Limited (OBL) has announced the publication of the Open Banking Standard version 4.0, following approval by the Trustee.

This is the first major release since 2018 and includes important mandatory updates to the security profile and widely recognised international messaging standards (ISO 20022). The release also includes optional updates to improve information flows (payment status and error messaging).

Marion King, OBL Trustee, said: “This is the first major release for several years and has been developed collaboratively with the entire ecosystem.”

“The Standard has laid the foundations for a thriving open banking ecosystem which benefits 9.79 million active users and is worth more than £4 billion to the UK economy. OBL will continue to maintain and update the Standard to ensure it is robust and able to support the future development of open banking. We will also continue to support JROC’s work to deliver the full benefits of open banking within retail banking markets, and beyond, retaining the UK’s position as a global leader in innovation.”

Fiona Hamilton, Standards Director, OBL, said: “Key updates, including the FAPI uplift, ISO 20022 alignment and information flow changes, are all incredibly important to deliver the best possible experience for open banking users.”

“It was very encouraging to see widespread support for the changes and we are grateful for the time and effort across the whole ecosystem to support its successful development. As the transition work unfolds, we will continue to maintain the Standard that underpins the UK’s open banking success, helping to deliver substantial benefits to users and the wider economy. The Department for Business and Trade estimates the value of open banking and smart data schemes will be worth around £28bn.”

The proposed updates reflect Order-related activity to uplift the security profile as the current version has been deprecated, and to ensure our Standard aligns with globally recognised messaging.

The updates regarding information flows, currently optional for implementation, were driven by workstream 4 of the JROC open banking roadmap (see page 8 here). We understand the FCA intends to consider changes to the regulatory framework to require provision of timely, definitive payment statuses and clear and consistent error messaging.

The OBL Technical Design Authority (TDA) voted to support the updates to the Read/Write specifications and the release also addresses several minor known issues and one change request to allow a CMA9 ASPSP to meet its regulatory obligations.

The design work was supported by an Expert Advisory Group (EAG) of over 40 participants, and held a 4.5-week consultation period.

Key changes in v4.0

- Uplift from FAPI 1.0 Implements Draft 2 (to be fully deprecated by the end of 2024) to FAPI 1.0 Advanced Final – a mandatory implementation requirement.

- Key changes to align with ISO 20022, including fields required to meet Bank of England CHAPS requirements from 1 May 2025 – mandatory implementation requirement where marked.

- Improved information flows to facilitate provision of timely, definitive payment statuses and clear and consistent error messages – optional implementation requirement.

- A centralised codeset repo for the code-sets that the specifications are aligned with.

- Updates to the read/write specifications to correct known issues.

- Updates to the Customer Experience Guidelines to provide FAPI guidance, TRI guidance and to support the information flow changes, including common scenarios and related errors.

- Updates to the Operational Guidelines to provide more guidance on breaking changes and new guidance on migration strategy for long-lived consents.

Please refer to the change logs for a complete view of all the changes in v4.0.

Companies In This Post

- QUBE Events Bring Back the 24th NextGen Payments & RegTech Forum Read more

- Ripple Redefines Payments with End-to-End Stablecoin Platform and Global Customer Momentum Read more

- Alkami Now a Nacha Preferred Partner for ACH Experience, Fraud Monitoring, and Risk and Fraud Prevention Read more

- What Turned Storm Chandra Into a UK Flood Crisis Read more

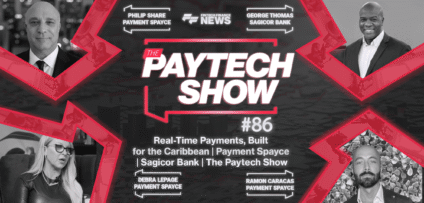

- Real-Time Payments, Built for the Caribbean | Payment Spayce | Sagicor Bank | The Paytech Show #86 Read more