Breaking News

Fintech start-up Shaparency launches to enable businesses to go fully digital

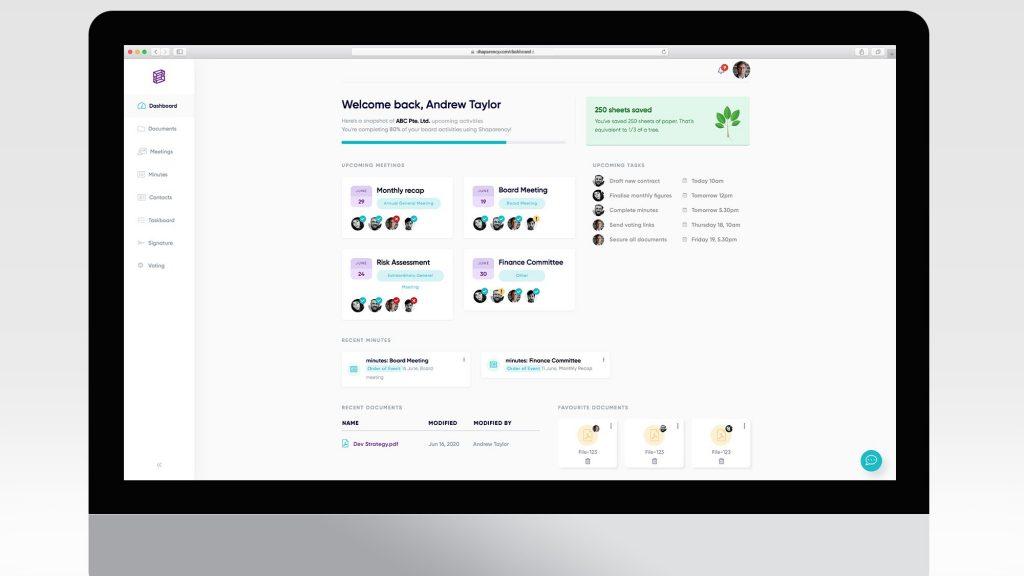

London-based start-up Shaparency, which has been established in response to the business conditions resulting from Covid-19, today (1st July) announces the launch of its board and shareholder management platform, helping businesses digitise governance and shareholder relations. The platform will increase the efficiency and effectiveness of board and shareholder operations to save time and money and to improve governance and the shareholder experience.

Shaparency has been designed from inception to reflect the circumstances and likely long-term shifts brought about by Covid-19, to enable businesses to digitally engage with their shareholders in an environment where social distancing and shielding of vulnerable individuals is commonplace.

Founded by Australian entrepreneur Ben Nowlan, Shaparency uses blockchain technology to provide an integrated digital platform through which businesses can remotely run board meetings and shareholder Annual General Meetings (AGMs), store governance documents, minutes and contacts, and manage shareholder relations.

Only 15% of corporate boards globally use digital management platforms as, to date, the costs of doing so have been prohibitive and board members have not shown technology readiness. Shaparency offers a highly competitive SaaS model which will enable boards, from SMEs and charities to multinationals, to better adapt to the new environment, increase efficiency, improve transparency and finetune governance.

The service will also transform shareholder experience and, engaging shareholders more personally and seamlessly than before. The platform will allow boards to communicate securely with shareholders, providing a portal for them to access company reports and minutes, vote, join meetings, and chat with others.

Board and shareholder meetings often have a significant environmental impact as a result of long-distance travel AGMs and the vast quantity of documents printed. Shaparency reduces the need for physical meetings by offering a virtual alternative and eradicates the need for print outs.

Shaparency is also committed to supporting boards in becoming greener. For the equivalent of every tree saved by not printing documents (8333 pieces of paper) Shaparency plants a tree. Companies can clearly see the impact which their switch to digital has had on the environment on the Shaparency dashboard.

Ben Nowlan, founder, said: “Over the past three months, we’ve seen the biggest shift in working practices for decades. Businesses are having to adapt to new ways of communicating and collaborating. Many of these new practices are here to stay. Business leaders are finally being given the push they need to transition to automated operations to build reliable, secure and transparent company governance structures.

“Even before the global pandemic, there was no need for governance and board activities to be so manual and rely on physical interaction to take place physically or behind closed doors. We have the technology to take all meetings, document storage and shareholder communications online, allowing for better and easier governance, greater transparency and less waste in the form of less travel and fewer documents being printed. Hopefully, our ‘new normal’ will help business leaders realise this more clearly and make the transition to fully automated governance.”

Other solutions of the platform include secure voting – all votes can be run directly from the platform and proxy votes can be collected securely and efficiently; creating a global task board; digitally signing document signings, cloud document storage and storing in a cloud location; email and calendar integration; document templates; and hosting and managing board and shareholder meetings in one portal from anywhere in the world.

- EXCLUSIVE: “Passion Project” – Brice van de Walle, Mastercard in ‘The Fintech Magazine’ Read more

- FreedomPay Drives Global Merchant Innovation Read more

- FIS Brings AI-Powered Advancements to Seamless, Personalized Digital Banking Experiences Read more

- Citi Ventures Invests in BVNK to Power the Next Generation of Financial Infrastructure Read more

- Nearly Two-Thirds of Global Retailers Say Payment Method Flexibility Drives Revenue Growth, ACI Worldwide Survey Finds Read more