Breaking News

FinTech firm Countingup blurs the lines between accountants and bank managers with the addition of a built-in profit and loss report to its business current accounts

Countingup is the first business current account in the UK to advance its web based accounting capability with the launch of profit and loss reports.

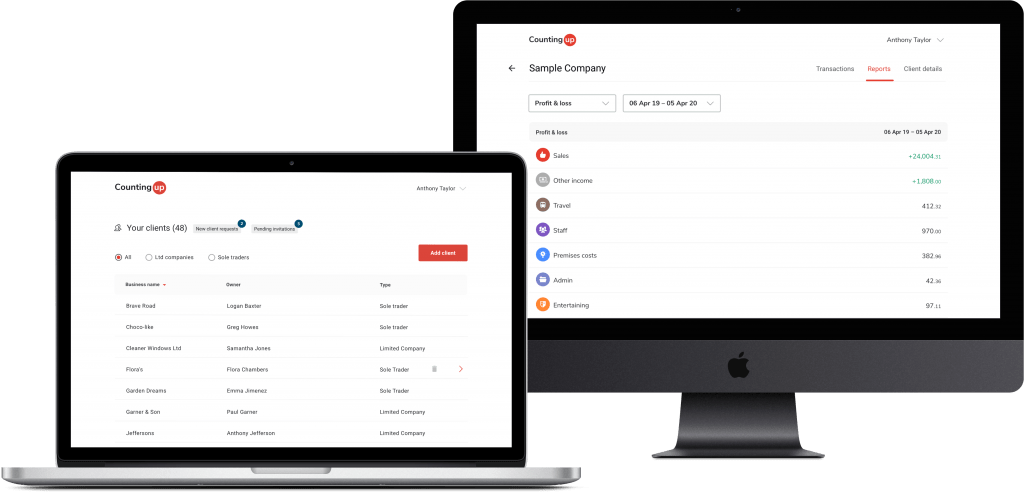

Countingup, the UK’s number one small business banking and accounting app, has launched a web based version of its popular banking and accounting app for accountants, complete with profit and loss reports.

Accountants can access, review and advise on their clients’ bank data as well as interpret how their clients are performing using Countingup’s web-based Accountant Hub. With bank branches closing in record numbers, the role of the accountant continues to broaden to fill this void. Accountants are extending beyond their core accounting work to also offer banking services and advice.

Tim Fouracre, founder and CEO of Countingup, said: “We’re excited to be at the forefront of changing the accounting industry to bring accountants more into the world of banking. Launching the profit and loss report in our web-based Accountant Hub is just the beginning. Soon accountants will have the ability to create journals, export a trial balance and submit an MTD compliant VAT return – all of this functionality sitting on top of our business current accounts.”

It’s a busy time of year for accountants with the self-assessment tax filing deadline looming on 31 January. The newly launched profit and loss report in Countingup’s Accountant Hub makes it easy to complete a tax return for those clients who have left it to the last minute. Many sole traders do leave it late. According to HMRC, 7% of tax returns were submitted late last year.

Over 400 accountants have registered for the Countingup Accountant Hub to access their clients’ bank transaction data. The Accountant Hub provides the functionality to re-categorise transactions, view receipts, read notes about transactions, export the data and to analyse how the business is performing with a powerful and flexible profit and loss report.

- Top Companies Supporting Former Workers with German Pension Refunds Read more

- Trust Travel, a TUI Brand, Partners With Qover to Deliver Seamless Travel Protection at Booking Read more

- New Partnership Introduces First-of-its-Kind Model To Democratise Olympic Sailing Read more

- Offa Outpaces High Street Banks on Speed With Islamic Mortgage Launch Read more

- Engine by Starling Enters Fourth Global Market With New Zealand’s SBS Bank Read more