Breaking News

Expansion of Banks into Rural Areas Helps fuel Boom in Card Acceptance in China

China’s banks target the rural population for further growth, while Visa and Mastercard lay the groundwork for a larger role in the Chinese payment cards market

The number of EFTPOS terminals in China rises 43% in one year

RBR’s Global Payment Cards Data and Forecasts to 2021 shows that China is home to 43% of the world’s payment cards and 29% of EFTPOS terminals, making it the largest market for card issuing and acceptance.

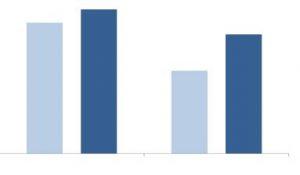

China continued its rapid expansion in 2015, with card numbers increasing by 10% to reach 5.5 billion. Growth has been driven by banks’ rural development strategies, with new products targeted heavily at farmers and small business owners. Meanwhile, the number of banked customers continues to climb apace, boosting cardholding. The RBR study shows that expansion into rural areas also helped the number of EFTPOS terminals rise by a staggering 43% in 2015, to 22.8 million.

Number of Cards and EFTPOS Terminals in China

Source: Global Payment Cards Data and Forecasts to 2021 (RBR)

Visa and Mastercard poised to expand their role in the vast Chinese market

Despite indications that the slowing Chinese economy will dampen growth in the country’s maturing cards market, its sheer size will continue to make it attractive to global card schemes.

In June 2015, the People’s Bank of China (PBOC) finally opened up China’s payment card market to applications from foreign players following the end of UnionPay’s monopoly on domestic bank card clearing. Visa and Mastercard have since been laying the groundwork to take on a larger role in the country, and are currently working to comply with PBOC’s regulations, including ensuring that they meet the security and encryption standards required.

Chris Herbert, who led RBR’s Global Payment Cards Data and Forecasts to 2021 research, remarked: “It will be interesting to see how the market develops now PBOC is opening the door for international competitors. We would not expect to see seismic shifts, but even a modest share of such a vast market would have a significant impact on Visa and Mastercard’s global businesses”.

- EXCLUSIVE: “Passion Project” – Brice van de Walle, Mastercard in ‘The Fintech Magazine’ Read more

- FreedomPay Drives Global Merchant Innovation Read more

- FIS Brings AI-Powered Advancements to Seamless, Personalized Digital Banking Experiences Read more

- Citi Ventures Invests in BVNK to Power the Next Generation of Financial Infrastructure Read more

- Nearly Two-Thirds of Global Retailers Say Payment Method Flexibility Drives Revenue Growth, ACI Worldwide Survey Finds Read more